“We worked closely with President Trump to pass historic tax cuts and simplify the tax code for individuals and businesses. Those efforts generated new jobs, economic growth, and opportunities for all Americans.“

During the 115th Congress, I voted for and helped pass generational tax reform through the Tax Cuts & Jobs Act. The legislation greatly simplified the tax code and lowered rates across the board. Those changes helped drive economic growth and increase household income for American families. However, the incoming administration has threatened to raise taxes on individuals and businesses alike. Doing so would be detrimental to economic recovery efforts. As your Congressman, I will continue to support lower taxes and push back against any effort to raise taxes on hardworking American families.

More on Taxes

Higgins Urges Conference Committee to Include GOMESA Provision in Tax Cuts & Jobs Act

WASHINGTON, D.C. – Congressman Clay Higgins (R-LA) joined a group of Gulf Coast lawmakers on a letter urging House Leadership and members of the conference committee on tax reform to include the...

Higgins Urges Conference Committee to Include Key Provisions in Tax Bill

Congressman Clay Higgins (R-LA) sent a 3-page, detailed letter to Chairman Kevin Brady (R-TX) and other members of the conference committee on tax reform, urging them to include several key...

Higgins Votes to Pass Historic Tax Reform Bill

WASHINGTON, D.C. – The U.S. House of Representatives passed the Tax Cuts & Jobs Act today, which would be the first major overhaul of the U.S. tax code since 1986. The bill passed by a 227-205...

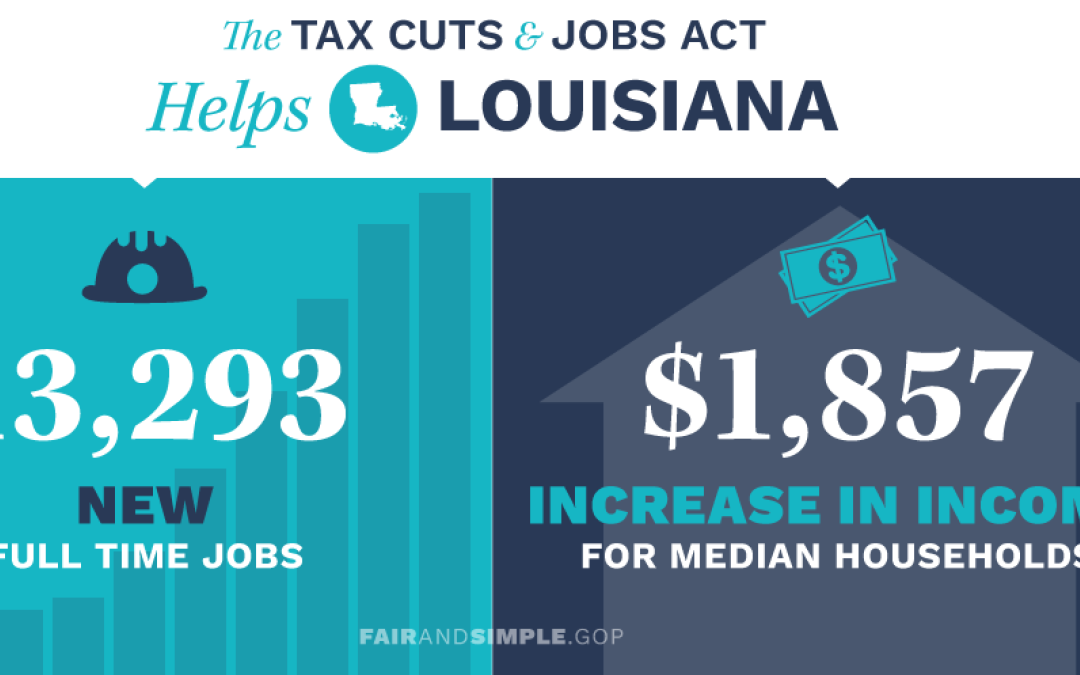

U.S. Chamber of Commerce Confirms Tax Cuts & Jobs Act Benefits Louisiana

WASHINGTON, D.C. – The U.S. Chamber of Commerce released a fact sheet today, showing the positive impact of the Tax Cuts & Jobs Act on Louisiana's third congressional district. The Chamber notes...

What Does Tax Reform Mean for You and Your Family?

The Tax Cuts and Jobs Act is a bold, pro-growth bill that will overhaul our nation's tax code for the first time since President Reagan's historic tax reform 31 years ago. With this bill, a typical...