LAFAYETTE, LA – Congressman Clay Higgins (R-LA) sent a letter to the Internal Revenue Service (IRS), asking them to clarify the process for individual recovery rebates after guidance posted Monday seemingly contradicted language in the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

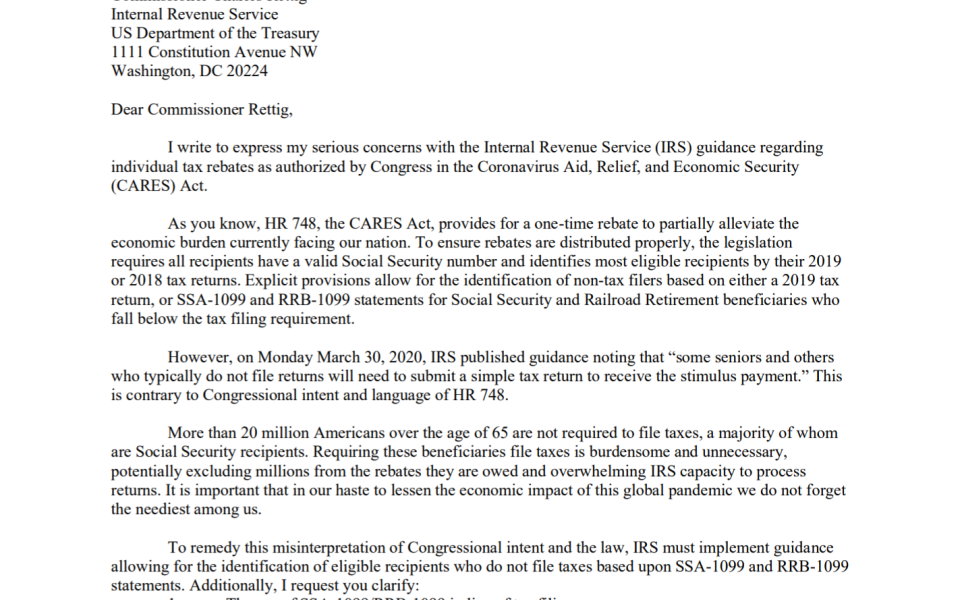

The letter reads, in part, “Explicit provisions allow for the identification of non-tax filers based on either a 2019 tax return, or SSA-1099 and RRB-1099 statements for Social Security and Railroad Retirement beneficiaries who fall below the tax filing requirement. However, on Monday, March 30, 2020, IRS published guidance noting that ‘some seniors and others who typically do not file returns will need to submit a simple tax return to receive the stimulus payment.’ This is contrary to Congressional intent and language of HR 748.”

Congressman Higgins issued the following statement:

“We must provide Americans with clear guidance on the recovery rebate process. The intent of the CARES Act was to simplify this process for Seniors, Social Security recipients, and other traditional non-filers by using information already available to the federal government. We want to ensure the IRS follows through on that goal.”

View the full letter as a pdf here.