The U.S. Treasury Department recently released updated income tax withholding guidance reflecting the enactment of the Tax Cuts and Jobs Act. Here’s a quick rundown of the Five Ws –Who, What, Where, When, andWhy – to help you understand what this means for you.

Why These Updates Mean More Take-Home Pay

- Federal tax withholding is how much of your pay the federal government takes from every paycheck. Under the Tax Cuts and Jobs Act, the federal government will take less because the law lowers tax rates for Americans of all income levels and nearly doubles the standard deduction.

Who Will See the Difference: The Vast Majority of Taxpayers

- As Treasury Secretary Steven Mnuchin explains, the historic tax relief provided by the Tax Cuts and Jobs Act – and the updated tax withholding guidance – will help taxpayers across the country:

“With this guidance, most American workers will begin to see bigger paychecks. We estimate that 90 percent of wage earners will experience an increase in their take-home pay.”

Where to Look on Your Pay Stub

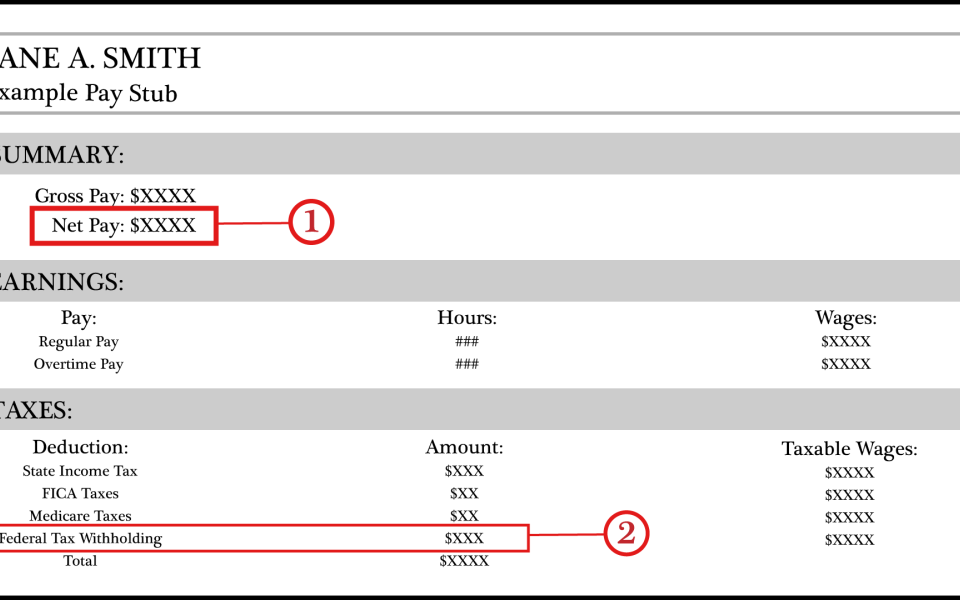

- For most taxpayers, there are two key places on a typical pay stub where you will see the effect of the Tax Cuts and Jobs Act:

- Net Pay: This is the total amount of money you keep from every paycheck after federal income taxes and other deductions. With the Tax Cuts and Jobs Act, this number will be larger due to the lower tax rates and significantly larger standard deduction.

- Federal Tax Withholding: This is the amount of your pay the federal government takes from every paycheck for income taxes. With the Tax Cuts and Jobs Act, this number will go down in comparison to your old pay stubs.

When You Will See the Increase in Your Paycheck

- Employers can immediately begin using the new withholding tables for their workers and have until February 15 to make the updates. According to the IRS, this means:

“Employees should begin to see withholding changes in their checks in February. The exact timing depends on when their employer can make the change and how often they are paid. It typically takes payroll providers and employers about a month to update withholding changes on their systems.”

What You Can Look Forward to Next

- Already in 2018, the Tax Cuts and Jobs Act has resulted in more than 300 companies announcing new investments in America, creating new jobs, and increasing pay and benefits for their workers. So not only will the law allow Americans to keep more of their take-home pay, it is contributing to more jobs and bigger paychecks across the country.

CLICK HERE for more information about the updated withholding guidance for the Tax Cuts and Jobs Act.

CLICK HERE to learn more about what this historic tax reform law means for you and your family.